SAN JOSE, USA & SINGAPORE: Avago Technologies, a leading supplier of analog interface components for communications, industrial and consumer applications, announced a new ultra-thin integrated optical proximity sensor for use in a wide range of portable consumer electronic devices, and personal computers.

Avago’s APDS-9120 proximity sensor combines a built-in signal conditioning IC, emitter and detector into a single package which offers both analog and digital output options for easy installation. This proximity sensor is ideal for use in mobile phones, PDAs, handheld games, and notebook computers.

With a surface mountable package size that is 1.1 mm thick by 4.4x4.4mm, the APDS-9120 offers many technical features required by mobile phone manufacturers such as an extended detection range, and superior signal conditioning circuitry, which offers superior performance in bright sunlight conditions.

Additionally, this integrated proximity sensor is very robust and provides application designers with ease of implementation as it eliminates the need for an external LED driver, signal filtering and amplification, as well as sunlight and ambient light immunity. This sensor also incorporates a stuck high protection circuit to preserve LED life.

Competitively priced, the APDS-9120 includes a shutdown mode to conserve power consumption and extend battery life in portable devices. Additionally, the pulse width, burst rate, duty cycle and frequency can be controlled to further minimize power consumption. Moreover, with an external limiting resistor, the LED current of this optical proximity sensor can be configured to a variety of levels.

Key features

* Patented ambient light cancellation circuit. Operational up to 100K lux to prevent false triggering.

* Analog and digital option to provide design and application flexibility.

* One of the longest detection distances available. Typical detection distance of 30 mm based on Kodak 18 percent grey card.

* Sensing capabilities adjustable from 10kHz to 1 MHz to provide faster detector response time.

* Supports burst pulse mode to help reduce power consumption.

* Shutdown current: 1uA maximum.

* Supply voltage: 2.4V to 3.6 V.

* RoHS compliant.

Tuesday, June 30, 2009

National Semi intros industry's first high-side dual LED Flash driver

SANTA CLARA, USA: National Semiconductor Corp. has introduced the industry's first high-side light-emitting diode (LED) driver that enables dual LED operation for the camera flash function in portable, battery-powered multimedia devices.

The LM3554, a member of National's PowerWise energy-efficient product family, drives one or two high-current LEDs for flash applications in handheld devices such as mobile phones, smartphones and portable scanners.

Traditional LED flash drivers sink current from a single high-current LED back into the driver resulting in significant heat dissipation into the driver IC and reduced system reliability. The LM3554's dual LED, high-side current-drive architecture sources regulate current into two LEDs with cathodes connected directly to the ground.

This ground connection provides more effective thermal dissipation while minimizing routing complexity and protecting sensitive circuitry. Due to nonlinearity of LED light output versus LED current, the dual LED architecture consumes less power for the same light output as a single LED.

In addition, monitoring pins enable detection of other high current demands in the system, adaptively throttling the LED current to avoid drawing excessive battery current, which can cause faults or harm the system.

The LM3554 is offered in a 16-pin micro SMD package. A complete boost converter solution for LED flash using National's LM3554 measures less than 23sq. mm.

The LM3554, a member of National's PowerWise energy-efficient product family, drives one or two high-current LEDs for flash applications in handheld devices such as mobile phones, smartphones and portable scanners.

Traditional LED flash drivers sink current from a single high-current LED back into the driver resulting in significant heat dissipation into the driver IC and reduced system reliability. The LM3554's dual LED, high-side current-drive architecture sources regulate current into two LEDs with cathodes connected directly to the ground.

This ground connection provides more effective thermal dissipation while minimizing routing complexity and protecting sensitive circuitry. Due to nonlinearity of LED light output versus LED current, the dual LED architecture consumes less power for the same light output as a single LED.

In addition, monitoring pins enable detection of other high current demands in the system, adaptively throttling the LED current to avoid drawing excessive battery current, which can cause faults or harm the system.

The LM3554 is offered in a 16-pin micro SMD package. A complete boost converter solution for LED flash using National's LM3554 measures less than 23sq. mm.

Saturday, June 27, 2009

34 billion LEDs for TFT LCD backlights in 2012

AUSTIN, USA: Light emitting diodes (LEDs) have been a hot topic in the TFT LCD market due to their rapid adoption in notebook PC displays and the high potential in LCD TV panels.

In 2012, 34 billion LEDs will be used in TFT LCD backlights, in sizes ranging from 1” to more than 70”, up more than 300 percent from 8 billion in 2008, according to the new DisplaySearch report Display LEDs: Lighting Up the Display World.

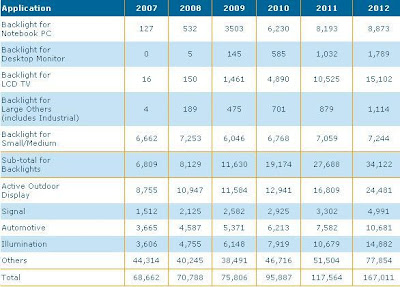

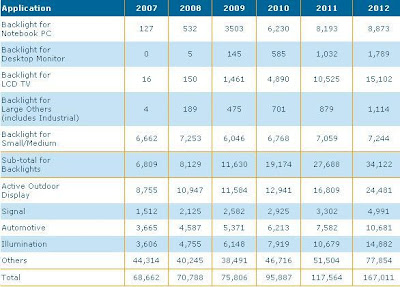

A total of 70.8 billion LEDs were shipped in 2008 (see Table 1). There are two categories of LEDs used in display applications; active outdoor displays, which used 11 billion LEDs or 15 percent of the total in 2008, and LCD backlights, which consumed 8 billion or 11 percent of the total. Within LCD backlight applications, five key types are adopting LEDs: small/medium, notebook PC, desktop monitors, industrial applications, and most notably TV.

Table 1: LED Demand by Application (Millions of Units) Source: DisplaySearch Display LEDs: Lighting Up the Display World

Source: DisplaySearch Display LEDs: Lighting Up the Display World

With the fast growth in LED outdoor displays and backlights, DisplaySearch forecasts that display LEDs, including 24 billion for active outdoor display and 34 billion for LCD backlights, will have a 34.7 percent share of the global 167 billion unit LED market in 2012, making display LEDs the largest market segment.

Low-current LEDs will be the mainstream type used in large-area LCD backlights, due to cost, thermal management and luminance efficiency requirements. High-power LEDs, with a driving current higher than 350 mA (more than 1W), are not well-suited for LCD backlights due to thermal issues, and will mainly be used in general lighting applications that require high brightness.

Shipments of LED backlights for large-size (10”+) TFT LCDs will exceed 368 million in 2012, an amazing 25 times 2008 shipments (Fig. 1). For LCD backlights, side-view LEDs enable slim design, and dominate small/medium LCD backlights.

Large-size (10”+) LCD backlights typically use top-view LEDs, and with the increased penetration of LED backlights in notebook PCs and increasingly TVs, top-view LED shipments will pass side-view in 2010.

Fig. 1: Large Size (10”+) LED Backlight Shipments by Application (Thousands) Source: DisplaySearch Display LEDs: Lighting Up the Display World

Source: DisplaySearch Display LEDs: Lighting Up the Display World

The penetration rate of LED backlights in notebook PCs will reach 52 percent in 2009, and DisplaySearch forecasts penetration will grow rapidly to 81 percent in 2010.

In LCD TV, the penetration rate will ramp up from 3% with 3.6 million units in 2009 to 10 percent with 15 million units in 2010. Leading LCD TV brands including Samsung, Philips, Sharp, Sony, Toshiba, Vizio and LG are planning increased use of LED backlights starting in the second half of 2009.

A driving factor is the change in LED backlight structure from direct to edge light type, which reduces the cost premium over CCFL backlights. Finally, LED backlights in desktop monitors are expected to reach 31 million units in 2012.

Eyeing the growing LED needs for their panels, nearly all panel makers are participating in the LED business through new LED companies or investments in existing manufacturers.

DisplaySearch analysis indicates that Nichia and Toyota Gosei will continue to dominate the market for blue and white LEDs for LCD backlights over the next three years, due to their strong patent portfolios and customer relationships.

However, Samsung LED, Stanley, Citizen, Showa Denko, Seoul Semiconductor and OSRAM are targeting growth in LED backlights for LCD TVs. Finally, Taiwanese makers like Lite-On, Chi-Mei Lighting, Lighthouse and Everlight are entering the backlight market with low cost structures.

The DisplaySearch Display LEDs: Lighting Up the Display World report also reveals that LED revenues for outdoor displays will reach $1 billion in 2009 and are expected to grow to $1.5 billion in 2012. The use of LED outdoor displays in the 2008 Beijing Olympics provided international visibility, and such events will be a driving force for growth in LED outdoor displays in the coming years.

“LEDs will create new growth for the TFT LCD industry due to characteristics such as lowering power consumption, meeting green requirements, adding dimming capability, improving color performance and enabling slim and light form factors for LCD panels and applications,” noted Yoshio Tamura, Vice President of DisplaySearch and the component research team leader. “On the other hand, TFT LCDs also provide new vigor to the LED industry, as they open up broader applications requiring higher quality and more advanced technology.”

Tamura concluded, “The interaction between the LCD and LED industries can be viewed as a key development in electronics in the coming decades.

In 2012, 34 billion LEDs will be used in TFT LCD backlights, in sizes ranging from 1” to more than 70”, up more than 300 percent from 8 billion in 2008, according to the new DisplaySearch report Display LEDs: Lighting Up the Display World.

A total of 70.8 billion LEDs were shipped in 2008 (see Table 1). There are two categories of LEDs used in display applications; active outdoor displays, which used 11 billion LEDs or 15 percent of the total in 2008, and LCD backlights, which consumed 8 billion or 11 percent of the total. Within LCD backlight applications, five key types are adopting LEDs: small/medium, notebook PC, desktop monitors, industrial applications, and most notably TV.

Table 1: LED Demand by Application (Millions of Units)

Source: DisplaySearch Display LEDs: Lighting Up the Display World

Source: DisplaySearch Display LEDs: Lighting Up the Display WorldWith the fast growth in LED outdoor displays and backlights, DisplaySearch forecasts that display LEDs, including 24 billion for active outdoor display and 34 billion for LCD backlights, will have a 34.7 percent share of the global 167 billion unit LED market in 2012, making display LEDs the largest market segment.

Low-current LEDs will be the mainstream type used in large-area LCD backlights, due to cost, thermal management and luminance efficiency requirements. High-power LEDs, with a driving current higher than 350 mA (more than 1W), are not well-suited for LCD backlights due to thermal issues, and will mainly be used in general lighting applications that require high brightness.

Shipments of LED backlights for large-size (10”+) TFT LCDs will exceed 368 million in 2012, an amazing 25 times 2008 shipments (Fig. 1). For LCD backlights, side-view LEDs enable slim design, and dominate small/medium LCD backlights.

Large-size (10”+) LCD backlights typically use top-view LEDs, and with the increased penetration of LED backlights in notebook PCs and increasingly TVs, top-view LED shipments will pass side-view in 2010.

Fig. 1: Large Size (10”+) LED Backlight Shipments by Application (Thousands)

Source: DisplaySearch Display LEDs: Lighting Up the Display World

Source: DisplaySearch Display LEDs: Lighting Up the Display WorldThe penetration rate of LED backlights in notebook PCs will reach 52 percent in 2009, and DisplaySearch forecasts penetration will grow rapidly to 81 percent in 2010.

In LCD TV, the penetration rate will ramp up from 3% with 3.6 million units in 2009 to 10 percent with 15 million units in 2010. Leading LCD TV brands including Samsung, Philips, Sharp, Sony, Toshiba, Vizio and LG are planning increased use of LED backlights starting in the second half of 2009.

A driving factor is the change in LED backlight structure from direct to edge light type, which reduces the cost premium over CCFL backlights. Finally, LED backlights in desktop monitors are expected to reach 31 million units in 2012.

Eyeing the growing LED needs for their panels, nearly all panel makers are participating in the LED business through new LED companies or investments in existing manufacturers.

DisplaySearch analysis indicates that Nichia and Toyota Gosei will continue to dominate the market for blue and white LEDs for LCD backlights over the next three years, due to their strong patent portfolios and customer relationships.

However, Samsung LED, Stanley, Citizen, Showa Denko, Seoul Semiconductor and OSRAM are targeting growth in LED backlights for LCD TVs. Finally, Taiwanese makers like Lite-On, Chi-Mei Lighting, Lighthouse and Everlight are entering the backlight market with low cost structures.

The DisplaySearch Display LEDs: Lighting Up the Display World report also reveals that LED revenues for outdoor displays will reach $1 billion in 2009 and are expected to grow to $1.5 billion in 2012. The use of LED outdoor displays in the 2008 Beijing Olympics provided international visibility, and such events will be a driving force for growth in LED outdoor displays in the coming years.

“LEDs will create new growth for the TFT LCD industry due to characteristics such as lowering power consumption, meeting green requirements, adding dimming capability, improving color performance and enabling slim and light form factors for LCD panels and applications,” noted Yoshio Tamura, Vice President of DisplaySearch and the component research team leader. “On the other hand, TFT LCDs also provide new vigor to the LED industry, as they open up broader applications requiring higher quality and more advanced technology.”

Tamura concluded, “The interaction between the LCD and LED industries can be viewed as a key development in electronics in the coming decades.

Friday, June 26, 2009

ON Semiconductor intros 10A Supercapacitor-based LED flash driver

PHOENIX, USA: ON Semiconductor, a leading global supplier of high performance, energy efficient, silicon solutions has introduced the NCP5680 supercapacitor-optimized LED flash driver, capable of delivering up to 10 amperes (A) for photo flash and video light in ultra-slim camera phones and compact digital cameras.

“The NCP5680, combined with an ultra-thin prismatic supercapacitor, delivers an ideal LED flash and power management solution for slim camera phones and digital cameras,” said Marie-Therese Capron, ON Semiconductor director of low voltage power management products.

“This total LED flash solution supplies comparable light energy to xenon flash, but with only half of the comparable solution height, and no need for an extra LED for video capture. Because the NCP5680 enables the Lithium-ion battery to support more power-hungry functions for a longer time, this new supercapacitor-based power management solution enables smart phones to offer ever richer functionality.”

When combined with the latest thin, prismatic supercapacitors - such as those offered by CAP-XX and licensed by Murata Manufacturing Co. Ltd, Japan, with a capacitance of up to 0.9F at 5.5 V -- and the high-power LED OSLUX from Osram -- ON Semiconductor’s NCP5680 complements the Lithium-ion battery by supplying high-peak-current of up to 10 A for flash lighting optimized for use with the BriteFlash Power Architecture developed by CAP-XX.

Fully programmable control of charging and discharging of the supercapacitor and unique overload protection ensures the right amount of light is provided for high-quality photography. The integrated driver can also power other high-peak-current circuits in portable systems, such as audio amplifiers, extending the useful battery operating time.

To produce high-resolution pictures in low-light conditions, cameras of 5 megapixels or more require a high-intensity flash. Today’s WLEDs can deliver this level of light energy, but require up to 400 percent more power than a camera battery can provide.

To support the battery, ON Semiconductor’s NCP5680 manages a supercapacitor to drive the LED flash to full intensity, supplying high-peak-current up to 10 A. The integrated driver in the NCP5680 also manages the supercapacitor to handle other peak-power needs -– zoom, auto-focus, audio, video, wireless transmissions, GPS readings and RF amplification –- extending battery life without compromising slimline design.

The NCP5680 integrates all circuitry required to charge the supercapacitor, manage in-rush current and control LED current, thus saving designers development time, board space and component cost. Fully programmable control of charging and discharging of the supercapacitor ensures the right amount of light for high-quality photography.

“The NCP5680, combined with an ultra-thin prismatic supercapacitor, delivers an ideal LED flash and power management solution for slim camera phones and digital cameras,” said Marie-Therese Capron, ON Semiconductor director of low voltage power management products.

“This total LED flash solution supplies comparable light energy to xenon flash, but with only half of the comparable solution height, and no need for an extra LED for video capture. Because the NCP5680 enables the Lithium-ion battery to support more power-hungry functions for a longer time, this new supercapacitor-based power management solution enables smart phones to offer ever richer functionality.”

When combined with the latest thin, prismatic supercapacitors - such as those offered by CAP-XX and licensed by Murata Manufacturing Co. Ltd, Japan, with a capacitance of up to 0.9F at 5.5 V -- and the high-power LED OSLUX from Osram -- ON Semiconductor’s NCP5680 complements the Lithium-ion battery by supplying high-peak-current of up to 10 A for flash lighting optimized for use with the BriteFlash Power Architecture developed by CAP-XX.

Fully programmable control of charging and discharging of the supercapacitor and unique overload protection ensures the right amount of light is provided for high-quality photography. The integrated driver can also power other high-peak-current circuits in portable systems, such as audio amplifiers, extending the useful battery operating time.

To produce high-resolution pictures in low-light conditions, cameras of 5 megapixels or more require a high-intensity flash. Today’s WLEDs can deliver this level of light energy, but require up to 400 percent more power than a camera battery can provide.

To support the battery, ON Semiconductor’s NCP5680 manages a supercapacitor to drive the LED flash to full intensity, supplying high-peak-current up to 10 A. The integrated driver in the NCP5680 also manages the supercapacitor to handle other peak-power needs -– zoom, auto-focus, audio, video, wireless transmissions, GPS readings and RF amplification –- extending battery life without compromising slimline design.

The NCP5680 integrates all circuitry required to charge the supercapacitor, manage in-rush current and control LED current, thus saving designers development time, board space and component cost. Fully programmable control of charging and discharging of the supercapacitor ensures the right amount of light for high-quality photography.

Microsemi's new line of standard rectifier diode power modules

IRVINE, USA: Microsemi Corp. has introduced a new line of standard rectifier diode power modules with 21 standard dual diode modules and six three-phase bridge rectifier diode power modules for industrial, UPS, SMPS, and motor drive applications.

All the new standard rectifier diode modules are rated at 1600 volts with a low forward voltage rating.

"With Microsemi's double isolation glass passivated rectifier chips, our standard rectifier modules provide superior reliability and performance over conventional modules on the market," said Philippe Dupin, Director, Power Module Products, Power Products Group located in Bordeaux, France.

"Our new standard rectifier portfolio has full mechanical and electrical compatibility with other modules in the industry, allowing Microsemi to equip the full range of power devices in a system from the input rectifier to the inverter output," he added.

Dual rectifier diode modules with 36A, 60A, 70A, 100A and 120A currents are integrated in the Microsemi SD1 package while 165A and 190A are offered in the SD2 package. MSCD Module reference specify a diode phase leg configuration while PN with MSAD and MSKD prefix include a common anode and common cathode configuration respectively.

The SD1, SD2, SM2 and SM3 packages -- with footprints respectively of 20mm x 93mm, 34mm x 93mm, 42mm x 72mm and 54mm x 94mm -- are fully compatible with other standard packages in the industry. At 30mm tall, they are also compatible in height with many standard IGBT modules, so that all modules from the input rectifier bridge to the converter output can be connected with the same level of bus bar or printed circuit board.

Technical data sheets are available on the Microsemi website. Samples are available immediately. Prices range from $8.42 to $30.86 in quantities of 1K to 5K.

All the new standard rectifier diode modules are rated at 1600 volts with a low forward voltage rating.

"With Microsemi's double isolation glass passivated rectifier chips, our standard rectifier modules provide superior reliability and performance over conventional modules on the market," said Philippe Dupin, Director, Power Module Products, Power Products Group located in Bordeaux, France.

"Our new standard rectifier portfolio has full mechanical and electrical compatibility with other modules in the industry, allowing Microsemi to equip the full range of power devices in a system from the input rectifier to the inverter output," he added.

Dual rectifier diode modules with 36A, 60A, 70A, 100A and 120A currents are integrated in the Microsemi SD1 package while 165A and 190A are offered in the SD2 package. MSCD Module reference specify a diode phase leg configuration while PN with MSAD and MSKD prefix include a common anode and common cathode configuration respectively.

The SD1, SD2, SM2 and SM3 packages -- with footprints respectively of 20mm x 93mm, 34mm x 93mm, 42mm x 72mm and 54mm x 94mm -- are fully compatible with other standard packages in the industry. At 30mm tall, they are also compatible in height with many standard IGBT modules, so that all modules from the input rectifier bridge to the converter output can be connected with the same level of bus bar or printed circuit board.

Technical data sheets are available on the Microsemi website. Samples are available immediately. Prices range from $8.42 to $30.86 in quantities of 1K to 5K.

Thursday, June 25, 2009

Taoglas launches first smart meter embedded antennae

ESCONDIDO, USA: Taoglas, the leading M2M antenna provider, launched the first smart meter embedded antennae with over 60 percent efficiency designed specifically for the utility market.

Called the FXP “Freedom” series, this range of six off-the-shelf flexible circuit antennas, works on three Industrial, Scientific and Medical (ISM) bands; 868 MHz, 915 MHz and 2.4 GHz.

The FXP freedom series antennas will enable metering companies to read smart meters in remote locations where wireless antennas previously did not work, such as basements, car parks and underground cavities. They are mechanically robust, able to withstand extreme temperature and humidity and have proven long lifetimes. They will also enable consumers and organizations to both conserve and cut the costs of energy.

The FXP antenna series is a super-thin 0.1 mm flexible circuit antenna. Similar to a piece of adhesive, it can be stuck directly to the housing or embedded into any metering device. Each design can be characterized and optimized for a meter and can even be integrated into existing meters that are being retrofitted for wireless functionality.

The presence of metal in many meters hinders larger FR4 type antennas, whereas the flexible antenna enables a greater clearance to be achieved. Unlike current market offerings that can take months to produce, Taoglas offers a customized antenna at any frequency that can be produced in three to four weeks or, an off-the-shelf solution for immediate use at the price that is lower than traditional antenna solutions.

“While the utility industry currently measures antenna performance using “gain”, at Taoglas, we think this is an outdated way of rating antenna performance. Antenna gain only measures performance in one direction in specific environments. Due to the wide variety of meter designs, housings and installation environments it is impossible to predict what direction an antenna is facing in relation to the base station.

Therefore, we take and apply mobile phone technology and specify “efficiency” for our antennas which gives metering companies an antenna performance over 360 degrees –- a much better performance indicator,” said Dermot O’Shea, Director, Taoglas.

Called the FXP “Freedom” series, this range of six off-the-shelf flexible circuit antennas, works on three Industrial, Scientific and Medical (ISM) bands; 868 MHz, 915 MHz and 2.4 GHz.

The FXP freedom series antennas will enable metering companies to read smart meters in remote locations where wireless antennas previously did not work, such as basements, car parks and underground cavities. They are mechanically robust, able to withstand extreme temperature and humidity and have proven long lifetimes. They will also enable consumers and organizations to both conserve and cut the costs of energy.

The FXP antenna series is a super-thin 0.1 mm flexible circuit antenna. Similar to a piece of adhesive, it can be stuck directly to the housing or embedded into any metering device. Each design can be characterized and optimized for a meter and can even be integrated into existing meters that are being retrofitted for wireless functionality.

The presence of metal in many meters hinders larger FR4 type antennas, whereas the flexible antenna enables a greater clearance to be achieved. Unlike current market offerings that can take months to produce, Taoglas offers a customized antenna at any frequency that can be produced in three to four weeks or, an off-the-shelf solution for immediate use at the price that is lower than traditional antenna solutions.

“While the utility industry currently measures antenna performance using “gain”, at Taoglas, we think this is an outdated way of rating antenna performance. Antenna gain only measures performance in one direction in specific environments. Due to the wide variety of meter designs, housings and installation environments it is impossible to predict what direction an antenna is facing in relation to the base station.

Therefore, we take and apply mobile phone technology and specify “efficiency” for our antennas which gives metering companies an antenna performance over 360 degrees –- a much better performance indicator,” said Dermot O’Shea, Director, Taoglas.

Pickering Interfaces intros PXI digital I/O module

CLACTON ON SEA, UK: Pickering Interfaces is expanding its range of PXI products with the introduction of new high performance Digital I/O module.

The 40-413 is a 32 channel Digital I/O module with high current outputs and dual threshold voltage inputs available in three different modules. Typical applications will be found in military, aerospace and automotive function test systems.

The 40-413 is a 32 channel Digital I/O module with high current outputs and dual threshold voltage inputs available in three different modules. Typical applications will be found in military, aerospace and automotive function test systems.

The 40-413-001 provides 32 high side output drivers each capable of sourcing up to 2A from an external power supply. The 40-413-002 provides 32 low side drivers each capable of sinking up to 2A to ground. The 40-413-003 includes both high and low side drivers, allowing users the flexibility of supporting systems with mixed configurations where a mixture of high and low side drivers is required or different systems with both types of drive requirements.

Each output is capable of working with 40V power loads and is fully protected against over voltage spikes from inductive loads and short circuits from defective loads. Each output includes thermal protection to automatically shut the driver down when connected to a faulty load.

All models have 32 digital input channels which can compared to two user programmable threshold voltages that make it simple to check that the external inputs are high, low or intermediate voltages. Each input can withstand voltages to greater than 100V. The two variable threshold voltages can be set from 0.3V to 50V with nominally 12.5 mV resolution, allowing the 40-413 to work with all commonly found high voltage I/O applications.

The 40-413 is a 32 channel Digital I/O module with high current outputs and dual threshold voltage inputs available in three different modules. Typical applications will be found in military, aerospace and automotive function test systems.

The 40-413 is a 32 channel Digital I/O module with high current outputs and dual threshold voltage inputs available in three different modules. Typical applications will be found in military, aerospace and automotive function test systems.The 40-413-001 provides 32 high side output drivers each capable of sourcing up to 2A from an external power supply. The 40-413-002 provides 32 low side drivers each capable of sinking up to 2A to ground. The 40-413-003 includes both high and low side drivers, allowing users the flexibility of supporting systems with mixed configurations where a mixture of high and low side drivers is required or different systems with both types of drive requirements.

Each output is capable of working with 40V power loads and is fully protected against over voltage spikes from inductive loads and short circuits from defective loads. Each output includes thermal protection to automatically shut the driver down when connected to a faulty load.

All models have 32 digital input channels which can compared to two user programmable threshold voltages that make it simple to check that the external inputs are high, low or intermediate voltages. Each input can withstand voltages to greater than 100V. The two variable threshold voltages can be set from 0.3V to 50V with nominally 12.5 mV resolution, allowing the 40-413 to work with all commonly found high voltage I/O applications.

3M's 19-micron embedded capacitance material for PCBs

AUSTIN, USA: The new 19-micron 3M Embedded Capacitance Material (ECM), introduced by 3M Electronic Solutions Division, offers printed circuit board manufacturers a high-performing choice for cost-sensitive applications.

3M ECM is a thin, high-performance embedded capacitor laminate for printed circuit boards. The material helps reduce impedance, power bus noise, EMI and discrete capacitor count. The material is designed for OEMs with high-speed digital and low-pass filter designs and who seek to differentiate their products through dramatically improved performance and reduced size.

The new 19-micron thickness is suited for cost-sensitive equipment, such as handheld electronics, where functionality and size constraints drive design.

The material’s high capacitive density allows it to perform the power supply decoupling function so that the number of discrete capacitors may be reduced, increasing useable board space and allowing for board size reduction.

3M ECM is compatible with most rigid and flex printed circuit board processing, including laser drilling. Fabricators and OEMs worldwide may use 3M ECM without a purchasing license from 3M. The material is RoHS compliant.

3M ECM is a thin, high-performance embedded capacitor laminate for printed circuit boards. The material helps reduce impedance, power bus noise, EMI and discrete capacitor count. The material is designed for OEMs with high-speed digital and low-pass filter designs and who seek to differentiate their products through dramatically improved performance and reduced size.

The new 19-micron thickness is suited for cost-sensitive equipment, such as handheld electronics, where functionality and size constraints drive design.

The material’s high capacitive density allows it to perform the power supply decoupling function so that the number of discrete capacitors may be reduced, increasing useable board space and allowing for board size reduction.

3M ECM is compatible with most rigid and flex printed circuit board processing, including laser drilling. Fabricators and OEMs worldwide may use 3M ECM without a purchasing license from 3M. The material is RoHS compliant.

Wednesday, June 24, 2009

High growth rates forecast for LED replacement lamp market

MOUNTAIN VIEW, USA: Market conditions are right for the LED replacement lamp market to accelerate in the next few years, according to a new market report by Strategies Unlimited, a leading firm covering the LED market.

Dramatic improvements in commercially available LED performance in recent years, as well as significant cost reduction, has made it feasible to design LED lamps to offer comparable lumen output and to compete with other established lighting technologies on the basis of cost of ownership.

The market is in a state of flux as utilities, energy efficiency organizations and customers look for optimum solutions which save energy, minimize the cost of ownership, and give acceptable quality of light. Customers are in the process of being educated about comparing cost of ownership rather than the initial price of lamps.

Regulations in Europe will ban the 100W incandescent clear glass lamp starting in September 2009, and will progressively ban all inefficient incandescent lamps by 2012 and all incandescent lamps by 2016.

The Energy Information and Security Act of 2007 began the process of restricting the sale of inefficient lamps in the US. By 2012, with a few exceptions, inefficient incandescent lamps cannot be sold. Although the awareness of these regulations is still weak in the marketplace, they will create market opportunities for LED replacement lamps.

Recognizing the potential of LED technology to save energy, policy makers have been supporting the research and development of LED technology and helping its commercialization. In the short run, while LED replacement lamps become a viable alternative, regulators are encouraging compact fluorescent lamps (CFLs).

However, over the next five years the advantages of LED technology over CFL will become recognized, especially with respect to the quality of light, dimmability, controllability, lamp life and environmental cost of ownership. Some well-designed LED lamps already offer effective lumen efficacies that compete with CFLs.

The commercial and industrial segments will embrace LEDs to control costs and save energy. The LED lamps will be used for directed light applications, in hard-to-reach places and where the cost of replacement is very high. Although the market for LED replacement lamps is still in its early stages of development, the lamp revenues are forecast to grow at a CAGR of 107 percent through 2013.

Dramatic improvements in commercially available LED performance in recent years, as well as significant cost reduction, has made it feasible to design LED lamps to offer comparable lumen output and to compete with other established lighting technologies on the basis of cost of ownership.

The market is in a state of flux as utilities, energy efficiency organizations and customers look for optimum solutions which save energy, minimize the cost of ownership, and give acceptable quality of light. Customers are in the process of being educated about comparing cost of ownership rather than the initial price of lamps.

Regulations in Europe will ban the 100W incandescent clear glass lamp starting in September 2009, and will progressively ban all inefficient incandescent lamps by 2012 and all incandescent lamps by 2016.

The Energy Information and Security Act of 2007 began the process of restricting the sale of inefficient lamps in the US. By 2012, with a few exceptions, inefficient incandescent lamps cannot be sold. Although the awareness of these regulations is still weak in the marketplace, they will create market opportunities for LED replacement lamps.

Recognizing the potential of LED technology to save energy, policy makers have been supporting the research and development of LED technology and helping its commercialization. In the short run, while LED replacement lamps become a viable alternative, regulators are encouraging compact fluorescent lamps (CFLs).

However, over the next five years the advantages of LED technology over CFL will become recognized, especially with respect to the quality of light, dimmability, controllability, lamp life and environmental cost of ownership. Some well-designed LED lamps already offer effective lumen efficacies that compete with CFLs.

The commercial and industrial segments will embrace LEDs to control costs and save energy. The LED lamps will be used for directed light applications, in hard-to-reach places and where the cost of replacement is very high. Although the market for LED replacement lamps is still in its early stages of development, the lamp revenues are forecast to grow at a CAGR of 107 percent through 2013.

LEMO connectors available with 48-hour assembly service

PHILADELPHIA, USA: Franchised assembly distributor PEI-Genesis has extended its connector component inventory and assembly capability to include LEMO connectors.

Authorized to distribute within the USA, PEI-Genesis is the only qualified LEMO assembly distributor, building connectors from component piece-parts.

Authorized to distribute within the USA, PEI-Genesis is the only qualified LEMO assembly distributor, building connectors from component piece-parts.

As with all of its assembled products, PEI-Genesis now offers thousands of possible LEMO connector part numbers with an unique 48-hour assembly service to customers.

PEI-Genesis President and COO, Russ Dorwart, said: "PEI-Genesis is the fastest robotic assembler of connectors in the world and LEMO push-pull connectors are a powerful addition to our connector offering. LEMO will enable PEI-Genesis to provide more mass-customized solutions to our customers, all within our 48 hour build-ship guarantee."

LEMO is a global leader of circular Push-Pull connectors that are found in a variety of challenging environments including medical, industrial control, test and measurement, audio-video, and telecommunications. The most popular of the LEMO push-pull connectors is the B Series (dustproof) for indoor applications and the K Series (watertight) for outdoor applications. Both are self-latching, multipole (2-64 contacts) connectors with an alignment key.

PEI-Genesis has been in business since 1946 and has been building connectors since 1952. It is the only value added connector distributor in the world that builds, tests, packages, and ships all orders within a 1.1 day cycle time and does so using proprietary robotic assembly equipment.

PEI-Genesis builds over 36,000 connectors per day and is one of the 15 largest distributors in North America. PEI-Genesis is focused on interconnect solutions with 21 sales offices backed by a strong team of Internal, Field, and Design Engineers.

Authorized to distribute within the USA, PEI-Genesis is the only qualified LEMO assembly distributor, building connectors from component piece-parts.

Authorized to distribute within the USA, PEI-Genesis is the only qualified LEMO assembly distributor, building connectors from component piece-parts. As with all of its assembled products, PEI-Genesis now offers thousands of possible LEMO connector part numbers with an unique 48-hour assembly service to customers.

PEI-Genesis President and COO, Russ Dorwart, said: "PEI-Genesis is the fastest robotic assembler of connectors in the world and LEMO push-pull connectors are a powerful addition to our connector offering. LEMO will enable PEI-Genesis to provide more mass-customized solutions to our customers, all within our 48 hour build-ship guarantee."

LEMO is a global leader of circular Push-Pull connectors that are found in a variety of challenging environments including medical, industrial control, test and measurement, audio-video, and telecommunications. The most popular of the LEMO push-pull connectors is the B Series (dustproof) for indoor applications and the K Series (watertight) for outdoor applications. Both are self-latching, multipole (2-64 contacts) connectors with an alignment key.

PEI-Genesis has been in business since 1946 and has been building connectors since 1952. It is the only value added connector distributor in the world that builds, tests, packages, and ships all orders within a 1.1 day cycle time and does so using proprietary robotic assembly equipment.

PEI-Genesis builds over 36,000 connectors per day and is one of the 15 largest distributors in North America. PEI-Genesis is focused on interconnect solutions with 21 sales offices backed by a strong team of Internal, Field, and Design Engineers.

Tuesday, June 23, 2009

Pulse's Halogen-free power bead inductor products

SAN DIEGO, USA: Pulse, a Technitrol company, a leader in electronic component and subassembly design and manufacturing, announced that its full line of power bead products, used in voltage regulators for computing applications and point-of-load (PoL) products, are now halogen-free.

Halogen elimination is part of Pulse’s on-going initiative to comply with the Registration, Evaluation, Authorization and Restriction of Chemical (REACH) regulation under EC 1907/2006.

Halogen elimination is part of Pulse’s on-going initiative to comply with the Registration, Evaluation, Authorization and Restriction of Chemical (REACH) regulation under EC 1907/2006.

Pulse’s halogen-free parts will be identified by the suffix HL, indicating that they comply with both halogen-free and lead-free standards. The first halogen-free series to be released was the PA0511, the most widely used power bead inductor series.

Soon to follow will be high-efficiency coupled inductors for graphics and server applications. To request halogen-free parts, customers simply enter HL in place of NL as the part number suffix.

“It was more difficult than expected to find materials that comply with the halogen-free standards of less than 900 parts per million (ppm) chlorine, 900ppm bromine, and 1500ppm combined,” explained John Gallagher, field applications engineer for Pulse.

“These elements often enter raw materials such as plastics and epoxies as impurities in the manufacturing process. Some vendors mistakenly think their products are halogen-free simply because they have not intentionally added these elements. Pulse decided to release the power bead products first, since many computer manufacturers requested them.”

Pulse’s highly efficient, off-the-shelf power beads offer high performance for multi-phase buck regulator applications. Their low direct current resistance (DCR) minimizes inductor conduction losses while their low-loss ferrite cores minimize inductor switching losses.

Plus, their small footprint enables flexibility in board layout. Power bead inductors come in through-hole and surface mount configurations for use in power supplies for desktop and notebook computers, servers, graphics cards, and PoL applications.

Halogen elimination is part of Pulse’s on-going initiative to comply with the Registration, Evaluation, Authorization and Restriction of Chemical (REACH) regulation under EC 1907/2006.

Halogen elimination is part of Pulse’s on-going initiative to comply with the Registration, Evaluation, Authorization and Restriction of Chemical (REACH) regulation under EC 1907/2006.Pulse’s halogen-free parts will be identified by the suffix HL, indicating that they comply with both halogen-free and lead-free standards. The first halogen-free series to be released was the PA0511, the most widely used power bead inductor series.

Soon to follow will be high-efficiency coupled inductors for graphics and server applications. To request halogen-free parts, customers simply enter HL in place of NL as the part number suffix.

“It was more difficult than expected to find materials that comply with the halogen-free standards of less than 900 parts per million (ppm) chlorine, 900ppm bromine, and 1500ppm combined,” explained John Gallagher, field applications engineer for Pulse.

“These elements often enter raw materials such as plastics and epoxies as impurities in the manufacturing process. Some vendors mistakenly think their products are halogen-free simply because they have not intentionally added these elements. Pulse decided to release the power bead products first, since many computer manufacturers requested them.”

Pulse’s highly efficient, off-the-shelf power beads offer high performance for multi-phase buck regulator applications. Their low direct current resistance (DCR) minimizes inductor conduction losses while their low-loss ferrite cores minimize inductor switching losses.

Plus, their small footprint enables flexibility in board layout. Power bead inductors come in through-hole and surface mount configurations for use in power supplies for desktop and notebook computers, servers, graphics cards, and PoL applications.

Microchip debuts low-power, high-precision op amps

CHANDLER, USA: Microchip Technology Inc. has announced three new families of low-power, high-precision operational amplifiers (op amps); meaning the Company now has an extensive offering of high precision Op Amps with Gain Bandwidth Product (GBWP) from 10 kHz to 50 MHz.

The MCP6051/2/4 (MCP605X), MCP6061/2/4 (MCP606X) and MCP6071/2/4 (MCP607X) op amps feature offset voltages of just 150 microvolts and are well suited for applications requiring low power consumption, low-voltage operation and high precision, such as those in the industrial, medical, consumer and other markets.

Developed in response to market demands for op amps providing low power and lower offset voltages, the MCP605X/6X/7X op amps are trimmed in-package to enable their low offset voltage, which results in reduced error at high gains.

The devices feature operating voltage from 1.8V to 6.0V, making them ideal for portable applications; and their rail-to-rail input and output provides greater dynamic range, even at lower operating voltages. Additionally, they are unity-gain stable and operate over the extended temperature range of – 40 to 125 degrees Celsius.

“Microchip has again leveraged its low-power, CMOS technology to provide additional families of industry-leading op amps, with the MCP605X/6X/7X devices,” said Bryan Liddiard, vice president of Microchip’s Analog and Interface Products Division. “These new devices lead the industry with their combination of low power consumption and low offset performance, and are expected to enable new markets for Microchip in portable instrumentation.”

Device-specific features

The MCP605X op amps have a GBWP of 385 kHz and a quiescent current of 30 microamperes. The MCP606X op amps have a GBWP of 730 kHz and a quiescent current of 60 microamperes. The MCP607X op amps have a GBWP of 1.2 MHz and a quiescent current of 110 microamperes.

All of the op amps are well suited for applications requiring low power consumption, low-voltage operation and high precision, such as portable instrumentation devices used in the industrial (portable gas detectors, pressure-monitoring devices, toll-booth tags, digital multimeters, RFID readers, bar-code scanners); medical (blood glucose meters, wearable heart-rate monitors and body-temperature measurement sensors); and consumer (gaming consoles, set-top boxes and portable audio players) markets.

Development support

PCB footprints and schematic symbols are expected to be available in August 2009 from Microchip’s Web site at http://www.microchip.com/cad. The downloads will be available in a neutral format that can be exported to the leading EDA CAD/CAE design tools using the Ultra Librarian Reader from Accelerated Designs Inc.

The MCP6051/2/4 (MCP605X), MCP6061/2/4 (MCP606X) and MCP6071/2/4 (MCP607X) op amps feature offset voltages of just 150 microvolts and are well suited for applications requiring low power consumption, low-voltage operation and high precision, such as those in the industrial, medical, consumer and other markets.

Developed in response to market demands for op amps providing low power and lower offset voltages, the MCP605X/6X/7X op amps are trimmed in-package to enable their low offset voltage, which results in reduced error at high gains.

The devices feature operating voltage from 1.8V to 6.0V, making them ideal for portable applications; and their rail-to-rail input and output provides greater dynamic range, even at lower operating voltages. Additionally, they are unity-gain stable and operate over the extended temperature range of – 40 to 125 degrees Celsius.

“Microchip has again leveraged its low-power, CMOS technology to provide additional families of industry-leading op amps, with the MCP605X/6X/7X devices,” said Bryan Liddiard, vice president of Microchip’s Analog and Interface Products Division. “These new devices lead the industry with their combination of low power consumption and low offset performance, and are expected to enable new markets for Microchip in portable instrumentation.”

Device-specific features

The MCP605X op amps have a GBWP of 385 kHz and a quiescent current of 30 microamperes. The MCP606X op amps have a GBWP of 730 kHz and a quiescent current of 60 microamperes. The MCP607X op amps have a GBWP of 1.2 MHz and a quiescent current of 110 microamperes.

All of the op amps are well suited for applications requiring low power consumption, low-voltage operation and high precision, such as portable instrumentation devices used in the industrial (portable gas detectors, pressure-monitoring devices, toll-booth tags, digital multimeters, RFID readers, bar-code scanners); medical (blood glucose meters, wearable heart-rate monitors and body-temperature measurement sensors); and consumer (gaming consoles, set-top boxes and portable audio players) markets.

Development support

PCB footprints and schematic symbols are expected to be available in August 2009 from Microchip’s Web site at http://www.microchip.com/cad. The downloads will be available in a neutral format that can be exported to the leading EDA CAD/CAE design tools using the Ultra Librarian Reader from Accelerated Designs Inc.

GigOptix books $1.5 million order for undersea optical drivers

PALO ALTO, USA: GigOptix Inc., a leading provider of electronic engines for the optically connected digital world, announced the booking of a $1.46M purchase order for its ultra long reach Mach-Zehnder Modulator (MZM) drivers.

The order, from a large European customer for undersea optical network cable drivers, is to be delivered in full during the second half of 2009.

“Despite the difficult market conditions, we see a continued healthy demand for our long reach and ultra long reach drivers for terrestrial and undersea optical cable links greater than 500 km. Our drivers, with integrated encoders for 10Gb/s RZ and RZ-DPSK modulation formats, are valued for their superior performance and offer the best jitter specifications in the market,” states Padraig O’Mathuna, Director of Product Marketing at GigOptix.

“This new order brings our expected 2009 sales to this customer to more than $3.5 million,” he added.

The order, from a large European customer for undersea optical network cable drivers, is to be delivered in full during the second half of 2009.

“Despite the difficult market conditions, we see a continued healthy demand for our long reach and ultra long reach drivers for terrestrial and undersea optical cable links greater than 500 km. Our drivers, with integrated encoders for 10Gb/s RZ and RZ-DPSK modulation formats, are valued for their superior performance and offer the best jitter specifications in the market,” states Padraig O’Mathuna, Director of Product Marketing at GigOptix.

“This new order brings our expected 2009 sales to this customer to more than $3.5 million,” he added.

Monday, June 22, 2009

Delta unveils high efficiency, compact E Series UPS (1kVA to 3kVA) for India

BANGALORE, INDIA: Delta Group, global leaders in power management solutions, has introduced a new range of 1kVA to 3kVA E–Series UPS systems for the Indian market.

The company has strengthened its portfolio by announcing the launch of E-Series UPS for its clients in small and medium enterprises (SMEs) and corporate segment.

The company has strengthened its portfolio by announcing the launch of E-Series UPS for its clients in small and medium enterprises (SMEs) and corporate segment.

The company’s current product portfolio includes comprehensive UPS solutions from 1kVA to 4000kVA for various growth verticals such as IT/ITes, Telecom, Banking & Finance, Process Control, Biotech, Healthcare, Retail, Infrastructure and Government.

The new range of single phase E-Series UPS system is a true, online design with double conversion technology to provide high performance and reliability for mission critical applications in compact size.

SMEs are increasingly becoming network dependent. Many have implemented ERP increasing the importance of uptime. Delta understands the SME sectors’ requirement has high focus on its business growth and therefore, cannot afford business downtime even for a short period of time due to any issues with peripheral equipment like UPS

Deepak Sharma, sales director for Delta UPS Systems in India, said: "Breaking the traditional barriers and concepts, the new E-series UPS is built on plug-n-play style, has intelligent self diagnostic functions, light-weight and provides freedom to choose extended runtime options. This launch is a definite step towards spreading our footprint across the country through introduction of new models and strengthening sales & service support network."

Among one of the fastest growing UPS companies in India, Delta’s intends to target the huge SMB segment which accounts for 50 percent of industrial output in India.

Main features and benefits:

* Microprocessor controlled, high frequency PWM technology based on ‘TRUE ONLINE’ double conversion UPS System with IGBTs at inverter stage and provides pure sine wave output with high reliability and efficiency.

* Input power factor correction up to unity to reduce input current resulting in lower electricity bills and minimizing harmonics making it truly ‘generator compatible’.

* High AC to AC efficiency resulting in lower running cost, quieter operation and lesser load on air conditioning making it a truly ‘green’ UPS.

* Widest input voltage range to help users’ maximize the mains utilization, thus saving on battery life and replacement costs. These UPSs operate on mains mode at voltages as low as 80V. To ensure that the batteries are used only when absolutely necessary.

* Extended battery runtime upto four hours as standard and scalable upto 24 hours.

* UPSentry network shutdown software through intelligent RS-232 communication interface.

* High input voltage withstand capability is provided up to 330V AC to make the UPS suitable for use in weak electrical grid areas also.

* Cold start allows the UPS to start on mains supply without batteries or on batteries without mains supply, a truly useful feature to power up loads even under emergency.

Delta E Series UPS has two-year warranty as per manufacture standard format and it is available in the Indian market at a starting range of price Rs. 9,999.

The company has strengthened its portfolio by announcing the launch of E-Series UPS for its clients in small and medium enterprises (SMEs) and corporate segment.

The company has strengthened its portfolio by announcing the launch of E-Series UPS for its clients in small and medium enterprises (SMEs) and corporate segment. The company’s current product portfolio includes comprehensive UPS solutions from 1kVA to 4000kVA for various growth verticals such as IT/ITes, Telecom, Banking & Finance, Process Control, Biotech, Healthcare, Retail, Infrastructure and Government.

The new range of single phase E-Series UPS system is a true, online design with double conversion technology to provide high performance and reliability for mission critical applications in compact size.

SMEs are increasingly becoming network dependent. Many have implemented ERP increasing the importance of uptime. Delta understands the SME sectors’ requirement has high focus on its business growth and therefore, cannot afford business downtime even for a short period of time due to any issues with peripheral equipment like UPS

Deepak Sharma, sales director for Delta UPS Systems in India, said: "Breaking the traditional barriers and concepts, the new E-series UPS is built on plug-n-play style, has intelligent self diagnostic functions, light-weight and provides freedom to choose extended runtime options. This launch is a definite step towards spreading our footprint across the country through introduction of new models and strengthening sales & service support network."

Among one of the fastest growing UPS companies in India, Delta’s intends to target the huge SMB segment which accounts for 50 percent of industrial output in India.

Main features and benefits:

* Microprocessor controlled, high frequency PWM technology based on ‘TRUE ONLINE’ double conversion UPS System with IGBTs at inverter stage and provides pure sine wave output with high reliability and efficiency.

* Input power factor correction up to unity to reduce input current resulting in lower electricity bills and minimizing harmonics making it truly ‘generator compatible’.

* High AC to AC efficiency resulting in lower running cost, quieter operation and lesser load on air conditioning making it a truly ‘green’ UPS.

* Widest input voltage range to help users’ maximize the mains utilization, thus saving on battery life and replacement costs. These UPSs operate on mains mode at voltages as low as 80V. To ensure that the batteries are used only when absolutely necessary.

* Extended battery runtime upto four hours as standard and scalable upto 24 hours.

* UPSentry network shutdown software through intelligent RS-232 communication interface.

* High input voltage withstand capability is provided up to 330V AC to make the UPS suitable for use in weak electrical grid areas also.

* Cold start allows the UPS to start on mains supply without batteries or on batteries without mains supply, a truly useful feature to power up loads even under emergency.

Delta E Series UPS has two-year warranty as per manufacture standard format and it is available in the Indian market at a starting range of price Rs. 9,999.

Sunday, June 21, 2009

Alternatives for RoHS restricted substances

This is a guest post by Gary Nevison, Head of Legislation, Farnell, A trading division of Premier Farnell UK Ltd.

Substitution of HBCDD, DEHP, BBP and DBP

Background

UK: Hexabromocyclododecane (HBCDD), Bis-ethylhexyl phthalate (DEHP), Butyl benzyl phthalate (BBP) and Dibutyl phthalate (DBP) are classified by the REACH regulations as Substances of Very High Concern (SVHCs) and are included in the “Candidate List”. They have also been proposed for inclusion in Annex XIV, substances requiring authorisation for use.

UK: Hexabromocyclododecane (HBCDD), Bis-ethylhexyl phthalate (DEHP), Butyl benzyl phthalate (BBP) and Dibutyl phthalate (DBP) are classified by the REACH regulations as Substances of Very High Concern (SVHCs) and are included in the “Candidate List”. They have also been proposed for inclusion in Annex XIV, substances requiring authorisation for use.

The European Commission (EC) has submitted proposals to amend the RoHS Directive (so called RoHS2) and one proposal is to consider adding these four substances to the list of restricted substances. The three phthalates are also banned in children’s products in the European Union (EU) and in the USA.

This article describes their main uses and possible alternatives.

Main uses

Table 1: Main uses of the substances Source: Farnell

Source: Farnell

Alternatives to HBCDD

HIPS

Two options are available; use a different brominated flame retardant or a different type of plastic. For example, decabromodiphenylethanol and ethylene bis-tetrabromophthalaimide are used as flame retardants in HIPS and can achieve UL94V0 and neither are restricted.

There are however no non-brominated flame retardants that can achieve UL94V0 in HIPS although there are several phosphorous-based flame retardants that can achieve UL94V0 in PC/ABS and PPE/HIPS blends which are often used for enclosures. However, some phosphorous flame retardants have certain hazardous properties and many are not fully tested.

Textiles

Several options are available including decabromodiphenyl ether (decaBDE) which is banned by RoHS but not in vehicles and some other applications. Chlorinated paraffins are also used but are toxic and aluminium polyphosphate which is the least hazardous option.

EPS

No alternatives exist that provide adequate flame retardancy but alternative insulation materials may be suitable. These include phenolic foams (highly persistent), polyurethane foams (very toxic fumes if burnt) and glass and mineral fibres.

XPS

No substitute flame retardants are available as all would need too high a loading and therefore the required properties of the XPS would not be met. Hence, different materials are the only alternative; starch based packaging chips and bubble wrap are two options.

Alternatives to DEHP, BBP and DBP

There are many alternatives, but most are not hazard-free and their properties differ. The following lists some of the more commonly used examples but many others are also used:

Table 2: Examples of alternatives plasticisers Source: Farnell

Source: Farnell

There are many others available including other phthalates, esters, phosphates, etc.

Conclusions

Hexabromocyclododecane, Bis-ethylhexyl phthalate, Butyl benzyl phthalate and Dibutyl phthalate are clearly hazardous chemicals so their use will, in the future, become increasingly restricted. There are many possible alternatives but choosing the best option is not straightforward. For each application, substitution will often give products with different properties and performance, which need to be assessed.

One of the main problems with choosing a substitute is to identify one that is safe to use and will not be restricted in the future. Di-isobutyl phthalate is the most common replacement for DBP but Germany has indicated that it intends to submit a proposal for di-isobutyl phthalate to be classified as a SVHC.

Most of the potential substitutes have not been extensively tested and in many cases test results are inconclusive or incomplete. However the test data that does exist for many of the possible alternatives indicates that they are safer options and many are increasingly used in preparations and in finished products.

Substitution of HBCDD, DEHP, BBP and DBP

Background

UK: Hexabromocyclododecane (HBCDD), Bis-ethylhexyl phthalate (DEHP), Butyl benzyl phthalate (BBP) and Dibutyl phthalate (DBP) are classified by the REACH regulations as Substances of Very High Concern (SVHCs) and are included in the “Candidate List”. They have also been proposed for inclusion in Annex XIV, substances requiring authorisation for use.

UK: Hexabromocyclododecane (HBCDD), Bis-ethylhexyl phthalate (DEHP), Butyl benzyl phthalate (BBP) and Dibutyl phthalate (DBP) are classified by the REACH regulations as Substances of Very High Concern (SVHCs) and are included in the “Candidate List”. They have also been proposed for inclusion in Annex XIV, substances requiring authorisation for use.The European Commission (EC) has submitted proposals to amend the RoHS Directive (so called RoHS2) and one proposal is to consider adding these four substances to the list of restricted substances. The three phthalates are also banned in children’s products in the European Union (EU) and in the USA.

This article describes their main uses and possible alternatives.

Main uses

Table 1: Main uses of the substances

Source: Farnell

Source: FarnellAlternatives to HBCDD

HIPS

Two options are available; use a different brominated flame retardant or a different type of plastic. For example, decabromodiphenylethanol and ethylene bis-tetrabromophthalaimide are used as flame retardants in HIPS and can achieve UL94V0 and neither are restricted.

There are however no non-brominated flame retardants that can achieve UL94V0 in HIPS although there are several phosphorous-based flame retardants that can achieve UL94V0 in PC/ABS and PPE/HIPS blends which are often used for enclosures. However, some phosphorous flame retardants have certain hazardous properties and many are not fully tested.

Textiles

Several options are available including decabromodiphenyl ether (decaBDE) which is banned by RoHS but not in vehicles and some other applications. Chlorinated paraffins are also used but are toxic and aluminium polyphosphate which is the least hazardous option.

EPS

No alternatives exist that provide adequate flame retardancy but alternative insulation materials may be suitable. These include phenolic foams (highly persistent), polyurethane foams (very toxic fumes if burnt) and glass and mineral fibres.

XPS

No substitute flame retardants are available as all would need too high a loading and therefore the required properties of the XPS would not be met. Hence, different materials are the only alternative; starch based packaging chips and bubble wrap are two options.

Alternatives to DEHP, BBP and DBP

There are many alternatives, but most are not hazard-free and their properties differ. The following lists some of the more commonly used examples but many others are also used:

Table 2: Examples of alternatives plasticisers

Source: Farnell

Source: FarnellThere are many others available including other phthalates, esters, phosphates, etc.

Conclusions

Hexabromocyclododecane, Bis-ethylhexyl phthalate, Butyl benzyl phthalate and Dibutyl phthalate are clearly hazardous chemicals so their use will, in the future, become increasingly restricted. There are many possible alternatives but choosing the best option is not straightforward. For each application, substitution will often give products with different properties and performance, which need to be assessed.

One of the main problems with choosing a substitute is to identify one that is safe to use and will not be restricted in the future. Di-isobutyl phthalate is the most common replacement for DBP but Germany has indicated that it intends to submit a proposal for di-isobutyl phthalate to be classified as a SVHC.

Most of the potential substitutes have not been extensively tested and in many cases test results are inconclusive or incomplete. However the test data that does exist for many of the possible alternatives indicates that they are safer options and many are increasingly used in preparations and in finished products.

Labels:

BBP,

DBP,

DEHP,

EC,

esters,

Farnell,

HBCDD,

phosphates,

phthalates,

REACH,

RoHS,

RoHS2,

SVHCs

Saturday, June 20, 2009

GigOptix extends DARPA research contract

PALO ALTO, USA: GigOptix Inc., a leading provider of electronic engines for the optically connected digital world, announced the extension of irs contract with DARPA MTO and with SPAWAR PACIFIC as the contracting agency.

The additional work requested is to fabricate low driving voltage, broadband Mach-Zehnder (MZ) modulators using GigOptix’s Electro-Optic (EO) polymer material for operation at very low temperatures for applications in supercomputers. The extension of $346,000 brings the total value of the contract to approx $6.1M and opens new areas for use of the modulators.

"Due to their intrinsic properties, the EO materials incorporated in GigOptix’s high speed polymer modulators have the potential to operate not only with low driving voltage but also at very low temperatures. Our technology is capable of effectively addressing all these requirements simultaneously," said Dr. Raluca Dinu, Vice President and General Manager of GigOptix-Bothell business unit.

"We are excited that GigOptix's EO polymer technology has once more proven its breadth and applicability for demanding military applications. We are continuing in parallel to commercialize the modulator for telecom applications and prove that EO polymers can offer the reliability requested by the industry."

Electro-optic polymer devices are well suited to deliver on the size, weight and power, high-bandwidth, and immunity to electromagnetic interference requirements that are crucial for many defense applications.

The additional work requested is to fabricate low driving voltage, broadband Mach-Zehnder (MZ) modulators using GigOptix’s Electro-Optic (EO) polymer material for operation at very low temperatures for applications in supercomputers. The extension of $346,000 brings the total value of the contract to approx $6.1M and opens new areas for use of the modulators.

"Due to their intrinsic properties, the EO materials incorporated in GigOptix’s high speed polymer modulators have the potential to operate not only with low driving voltage but also at very low temperatures. Our technology is capable of effectively addressing all these requirements simultaneously," said Dr. Raluca Dinu, Vice President and General Manager of GigOptix-Bothell business unit.

"We are excited that GigOptix's EO polymer technology has once more proven its breadth and applicability for demanding military applications. We are continuing in parallel to commercialize the modulator for telecom applications and prove that EO polymers can offer the reliability requested by the industry."

Electro-optic polymer devices are well suited to deliver on the size, weight and power, high-bandwidth, and immunity to electromagnetic interference requirements that are crucial for many defense applications.

Friday, June 19, 2009

Many patents in LED industry to expire in 2010!

DUBLIN, IRELAND: Research and Markets has announced the addition of the "Research Report of Global and Chinese Light-Emitting Diode Industry, 2009" report to its offering.

Light-emitting diode is one of the semiconductor diodes, which can turn electrical energy into luminous energy and emit visible light in various colors, such as yellow, green, blue, etc, as well as invisible light, such as infrared and ultraviolet light.

Compared with small incandescent bulb and the neon lamp, light-emitting diodes are specially characterized with low operating voltage and electric current, high reliability and long performance.

The entry barriers of the light-emitting diode industry from the upstream to the downstream are cut down gradually. The upstream industry includes mono-crystalline chip and the epitaxial wafer while the middle stream industry is mainly engaged in chip processing and the downstream industry handles packaging, testing and application.

The upstream and middle stream industries, most competitive and risky fields on world market, have higher technical contents and require more investments. In the industrial chain of light-emitting diode, epitaxial wafer and chip account for about 70 percent of profits and the packaging accounts for 10 to 20 percent of profits, with 10-20 percent held by application field.

Under international energy crisis and the gradual improvement of the environmental protection requirements, the semiconductor light-emitting diode lighting, long performance, energy saving, safe, green and environmental protection, abundant colors and microminiaturization, has been recognized as the only one manner of energy saving and environmental protection in the world.

The semiconductor lights, adopting light-emitting diode as the new lighting source, only run up one tenth of the electricity compared with the ordinary white light lamps and the performance can be postponed ten folds at the same brightness.

In 2007, the total amount of the global LED market exceeded $6 billion, up by 13.7 percent over the previous year. During 2006 to 2012, the annual compound growth rate of the global LED market will reach 10 percent, most of which will mainly be contributed by the ultra high and high brightness LEDs.

The global LED industry is mainly concentrated in Japan, Taiwan, Europe, America, South Korea, China, etc. Japan, the largest producer of the light-emitting diode industry in the world, holds 50 percent of the market share.

Nichia Corp. is the world's largest provider of the high-brightness light-emitting diodes. Toyoda Gosei Co. Ltd is the world's fourth largest and Japanese is the second largest manufacturer of the light-emitting diodes.

Osram Opto, located in the Europe and America, is the world's second largest and European is the largest manufacturer of the high-brightness light-emitting diodes. Taiwan, the global production base of the consumption electronic products, is mainly engaged in the production of the visible light-emitting diodes.

Taiwan is also the world's largest downstream packaging and middle stream chip production base.

With more than 30-year development, Chinese light-emitting diode industry has formed the basically complete industrial chains, covering the LED inside, epitaxial wafer, chip package and application.

At present, China has over 600 LED enterprises specializing in the downstream packaging and application. But the development of the epitaxial wafer and chip is comparatively backward. There are only about 10 enterprises engaged in the production of the epitaxial wafer for LED, as well as few chip manufacturers. So, the yield capacity enjoys a high degree of concentration.

With gradual enhancement of the luminous efficiency and application technologies, the application of the light-emitting diodes has been transferred from the initial indicator lights to screens, such as the landscape lighting, backlight, automobile lights, traffic lights, lighting areas, etc.

The application of the light-emitting diodes is now in diverse development. It is predicted that the average compound growth rate of sales of the display light-emitting diodes will be above 15 percent in 2006 to 2010 and the annual average compound growth rate of sales of the landscape lighting will reach over 35 percent, with the annual average compound growth rate of sales of the backlight light-emitting diodes at more than 30 percent.

In 2010, many patents in the light-emitting diode industry will expire. Chinese enterprises are expected to break through the shackles of the intellectual property rights from European, American and Japanese giants. They should make good use of huge market bases and abundant labor resources in order to occupy a place in the global light-emitting diode market.

Light-emitting diode is one of the semiconductor diodes, which can turn electrical energy into luminous energy and emit visible light in various colors, such as yellow, green, blue, etc, as well as invisible light, such as infrared and ultraviolet light.

Compared with small incandescent bulb and the neon lamp, light-emitting diodes are specially characterized with low operating voltage and electric current, high reliability and long performance.

The entry barriers of the light-emitting diode industry from the upstream to the downstream are cut down gradually. The upstream industry includes mono-crystalline chip and the epitaxial wafer while the middle stream industry is mainly engaged in chip processing and the downstream industry handles packaging, testing and application.

The upstream and middle stream industries, most competitive and risky fields on world market, have higher technical contents and require more investments. In the industrial chain of light-emitting diode, epitaxial wafer and chip account for about 70 percent of profits and the packaging accounts for 10 to 20 percent of profits, with 10-20 percent held by application field.

Under international energy crisis and the gradual improvement of the environmental protection requirements, the semiconductor light-emitting diode lighting, long performance, energy saving, safe, green and environmental protection, abundant colors and microminiaturization, has been recognized as the only one manner of energy saving and environmental protection in the world.

The semiconductor lights, adopting light-emitting diode as the new lighting source, only run up one tenth of the electricity compared with the ordinary white light lamps and the performance can be postponed ten folds at the same brightness.

In 2007, the total amount of the global LED market exceeded $6 billion, up by 13.7 percent over the previous year. During 2006 to 2012, the annual compound growth rate of the global LED market will reach 10 percent, most of which will mainly be contributed by the ultra high and high brightness LEDs.

The global LED industry is mainly concentrated in Japan, Taiwan, Europe, America, South Korea, China, etc. Japan, the largest producer of the light-emitting diode industry in the world, holds 50 percent of the market share.