Review of LED price in 2Q11

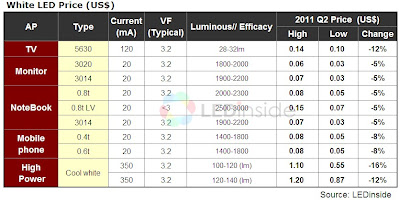

The LED price drops of different large-size panels have varied: the LED price of TV backlight applications (5630) plunged 10-15 percent, while the LED price of NB/MNT applications merely dropped 3-5 percent due to its mature technology and the fact that the price has hit the bottom over the past two years.

On the other hand, the weak demand has damped the overall mobile phone sales, which in turn result in a considerable setback in LED demand and an 8-10 percent price decline. As for the high-power LED of lighting applications, affected by the inventory adjustment, the price suffered a 10-15 percent decrease.

Source: LEDinside, Taiwan.

Source: LEDinside, Taiwan.Increasing players in TV backlight sector intensify price competition

On account of the horrid sales of LCD TV in 2Q11, the price cutting strategy and no signs of demand rebound, the price of 5630 dropped by 10-15 percent in 2Q11.

As for 3Q11, because of low demand for TV backlight demand and industry-wide the price cutting strategy, the price of 5630 is expected to plummet over 10 percent.

LED price of NB and tablet apps relatively stable

Because the specifications of LED backlight products have become more and more mature in the NB, monitor, mobile device applications. However, since 3014 LED could be adopted in the lighting applications, the price drop in 2Q11 was limited despite the weak demand in NB market.

As for tablet backlight applications, the mainstream specification is low-voltage LED (0.8t LV). Because of the limited players in the sector, the price remained relatively stable.

Due to brightness enhancement and inventory adjustment, lighting app price continued downtrend in 2Q11

In addition, LED lighting market demand is mainly underpinned by a few orders from commercial lighting and interior lighting sector, lack of subsidy policy causes a considerable decline in high-power LED price. Moreover, due to factors such as the increasing LED brightness by American and European major makers and the high inventory level, most of the manufacturers are forced to adopt the low-price strategy to propel sales.

According LEDinside, the price of high-power LED in 2Q11 continued the downtrend and dropped by 15%~20%; LED makers offered their major clients with even lower prices. As for the outlook in 3Q11, the pressure of lowering the price remains unchanged. Due to the steep price drop in 1H11, the high-power LED price is expected to see a mild drop in 2H11.

Perspectives from LEDinside

In light of that the LED backlight shipment in 1H11 fell short of expectation, products such as 5630 and 3014, which were originally adopted in backlight applications, are now adopted in lighting applications. In addition, many light product makers have replaced high-power LED with mid and low-power LED in order to reduce cost. With the weak demand in the backlight market, LED makers are expected to shift their focus to LED lighting application sector.

Based on LEDinside’s observation, currently the demands are mainly from Chinese and Japanese lighting markets. The LED demand in Japan has grown considerably due to the energy-saving policy after the earthquake: the penetration rate of LED light bulb has exceeded 30 percent in 2Q11. Besides, it is needed to observe the market demand in 3Q11 after the end of energy-saving policy.

With 2012 Olympics in the UK and the ban of incandescent light bulbs, it is estimated that the demand of LED module and LED lighting fixture might increase in the European market.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.